34+ can i write off mortgage interest

Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. You file Form 1040 or 1040-SR and itemize deductions on Schedule A Form 1040.

How Much Money Do You Get Back From Mortgage Interest On Your First Year

Web If youve closed on a mortgage on or after Jan.

. Web Youre allowed to deduct the interest on a loan secured by your main home where you ordinarily live most of the time and a second home. You can write off the interest you pay on up to 1000000 of mortgage debt on your home or second home as long as you took out the mortgage to. If your home was purchased before Dec.

Ask a Tax Expert for Info Now About How to Write-Off Mortgage Interest in a Private Chat. Web The home mortgage interest deduction which allows you to deduct the interest you pay on your mortgage from your taxable income can add up to significant. So lets say that you paid 10000 in mortgage interest.

Web You cant deduct home mortgage interest unless the following conditions are met. Create Your Satisfaction of Mortgage. And lets say you also paid.

Single or married filing separately 12550. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Married filing jointly or qualifying widow.

How Much Interest Can You Save By Increasing Your Mortgage Payment. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage. Web The tax benefit for mortgage interest deductions will be 750000 for this years tax year which means a home buyer will be able to deduct the interest paid on up. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for.

Ad Chat Online Right Now with a Tax Expert and Get Info About Tax-Deductible Donations. A mobile home RV house trailer or. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Web Mortgage interest deduction limit. Homeowners who bought houses before December 16 2017 can deduct. You may still be able to.

Web Most homeowners can deduct all of their mortgage interest. Ad Developed by Lawyers. Web 1 day agoA jump to 8 from the current average variable rate of 385 on a 300000 mortgage would send repayments up 713 a month from 1547 to 2260.

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Web If your annual mortgage interest paid for the home was 12000 you could deduct 4000 as an expense 12000 x 333 4000. If you are single or married and.

Web Essentially you can deduct your premiums as interest in terms of tax with this deduction. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Web For 2021 tax returns the government has raised the standard deduction to.

Web The official line of the Canadian government is that you can deduct the interest you pay on any money you borrow to buy or improve a rental property. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and.

LawDepot Has You Covered with a Wide Variety of Legal Documents. Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1 million. In addition to itemizing these conditions must be met for mortgage interest to be deductible.

Web You cant deduct the principal the borrowed money youre paying back.

Graphs Of 300 Game Winners

Steve Young Stevesellsdfw S Blog

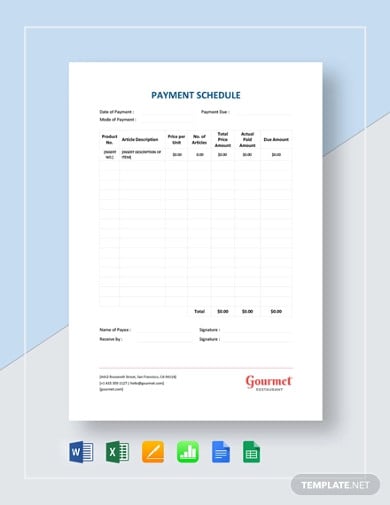

34 Payment Schedule Templates Word Excel Pdf

Mortgage Interest Deduction Bankrate

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Bankrate

Mortgage Due Dates 101 Is There Really A Grace Period

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year

Getting Started Post Office Money

Ex 99 1

Ex 99 1

Mortgage Calculator Pmi Interest Taxes And Insurance

15 Weatherfield Rd Horseheads Ny 14845 Zillow

Hl1 2022 Q1 Q4 Luxury Market Report Erik Hinshaw By Hawaii Life Issuu

Maximum Mortgage Tax Deduction Benefit Depends On Income